What Rolex Should You Wear to Your Next Holiday Party?

This is a tough question because I don’t know you. I’m sure I’d like to. You like watches, I like watches – that’s a pretty good basis for friendship as far as I see it. But even though I don’t know you, I know a lot of people who want to know which Rolex they should strap on their wrist for their next holiday party. Maybe you do, too? And so, I’m going to try to help you out.

I’m breaking down my choices into two categories: personal and situational. Here are two of each, plus one bonus choice that encompasses both.

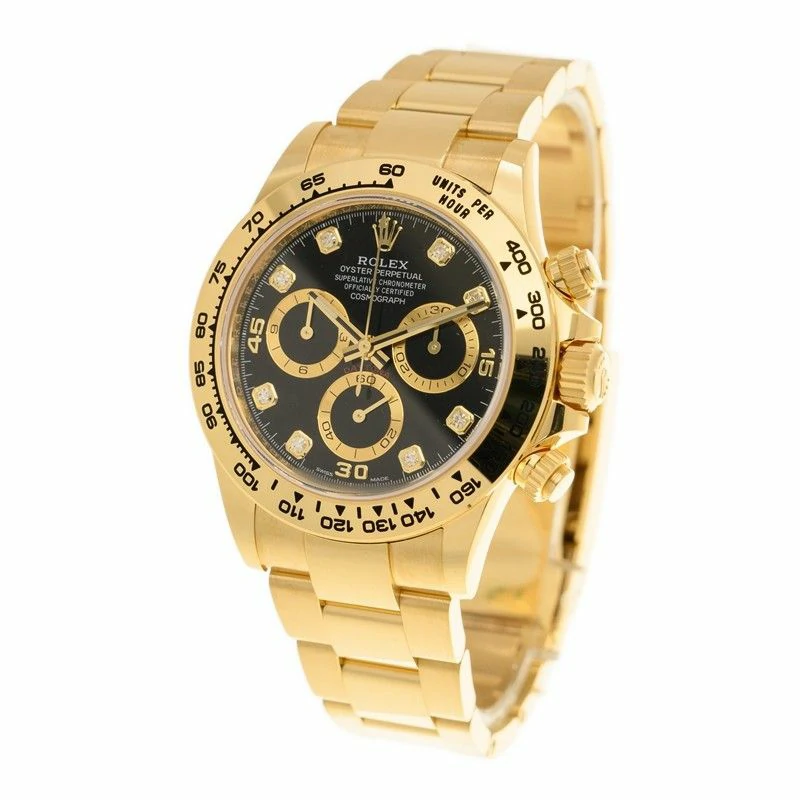

Personal: You’re a Baller and You Want Everyone to Know It

Bling, bling, baby. Okay, so you could go the diamond route, but if you’re just getting on the list now, you might be waiting a while. Instead, lean into the timeless power of gold. Everyone recognizes a gold Rolex replica. It remains the Western world’s most ubiquitous marker of success. With auction records for vintage Daytonas making headlines even in mainstream finance news, the gold Daytona has cemented its place in popular consciousness.

Situational: Your Partner Has Invited You to Spend the Holidays with Their In-Laws

First impressions matter, but so does fitting in. You can’t possibly pass up the opportunity to finally buy that Rolex Submariner you’ve been itching to pull the trigger on for years, can you? The Sub is a universally respected classic. It’s recognizable enough to spark conversation ( “Is that a Submariner?”) but understated enough not to intimidate. It speaks of tradition, reliability, and good taste – qualities any family hopes to see.

It’s your entry ticket to chats with uncles and grandfathers, a subtle nod that you appreciate the finer, enduring things in life. The stainless steel Submariner Date in black is a flawless choice.

Personal: You Love Watches, But You Don’t Love Being the Center of Attention

Not every statement needs to be loud. For the connoisseur who wears a watch purely for personal pleasure, the Oyster Perpetual is your secret handshake with yourself. With its clean dial, polished bezel, and legendary build quality, it’s a masterclass in refinement. It deflects flashy attention while rewarding a closer look.

Opt for a 41mm Oyster Perpetual with a sun-ray finish in a deep blue or elegant green. It’s the watch you’ll glance at throughout the evening, smiling, knowing its perfection is your little secret.

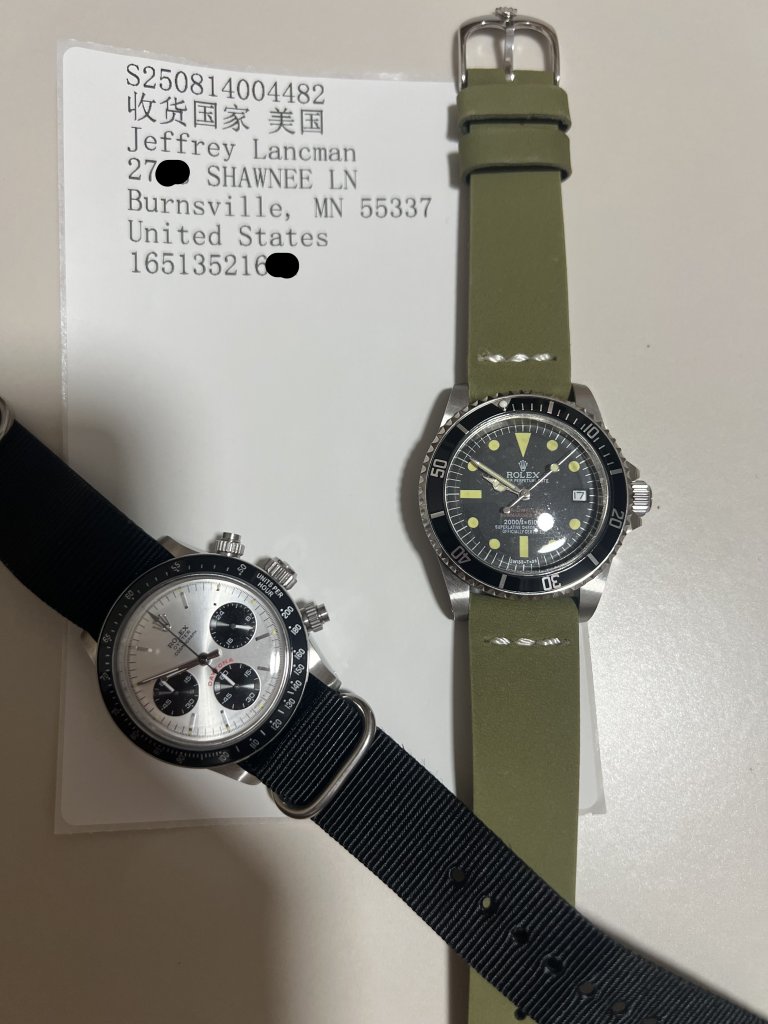

Situational: Your Local Watch Club is Throwing a Party

Here it is. Finally. Your chance to geek out among those who speak your language. Sure, you could impress with the latest GMT-Master II “Pepsi, ” or you could exercise true discernment and bring a piece of history.

Enter the vintage “Double Red “ Sea-Dweller (Reference 1665). With its two lines of red text and beautifully aged lume, it’s a unicorn that true enthusiasts will spot across a crowded room. It says you’re not just a buyer; you’re a student of the craft. It’s the ultimate conversation starter for the only crowd that will truly appreciate it.

Bonus: You Are Santa Claus and Mrs. Claus Wants You Back in Time for Christmas

Let’s be practical. Santa has a global route, tight deadlines, and a spouse who expects him home for milk and cookies. If Mrs. Claus gifted him a watch to commemorate his most important night, what would it be?

The answer is obvious: the Rolex GMT-Master II “Coke ” (Reference 16760, the “Fat Lady “). With its jet-black and bold red bezel matching his suit, and a GMT function to track multiple time zones (Reykjavik, Nairobi, Shanghai…), it’s the perfect tool for the job. It’s rugged, functional, and has just the right festive flair. If Santa isn’t checking his “Coke ” GMT before takeoff, I’ll eat my hat – bells and all.

Read More »